Top News Story –

Deutsche Bank’s painful self-help plan begins

The troubled German lender unveiled its long-awaited reorganization plan yesterday, which involves eliminating thousands of jobs and severely reducing its global ambitions. But is it too little, too late?

The bank plans to cut 18,000 jobs and shrink its global equities business. Top executives will leave, including its investment banking chief, and $300 billion worth of assets will be hived off in a “bad bank” to be sold off over time. The layoffs have already begun.

The firm will refocus its efforts on serving European companies and retail-banking customers, pulling back from nearly two decades of trying to compete with Wall Street giants. But its C.E.O., Christian Sewing, said this morning that the U.S. remains a core market for the bank.

The plan will cost the lender 7.4 billion euros, or $8.3 billion, in severance payments and other expenses through 2022. Dividends will be suspended for 2019 and 2020.

But experts are unsure whether it will work. Shrinking means reduced revenue, potentially creating a vicious circle of declining income and profits. Mohamed El-Erian of the German insurer Allianz tweeted, “Big question that’s now on the table is whether DB can shrink itself to heightened competitiveness and sustainable profitability without a merger of some sort.”

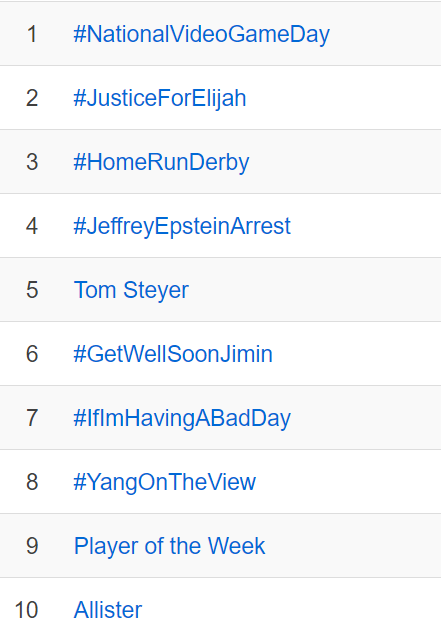

Twitter trends [from Trendinalia] – today from USA

Other News Stories –

Armed conflicts and attacks

- Saudi Arabian-led intervention in Yemen

- The United Arab Emirates announces a partial withdrawal of its forces from Yemen as part of a “strategic redeployment”. (CNN)

Disasters and accidents

- Flash flooding in Washington, D.C. delivers a month’s worth of rain on the local area in the span of an hour. The torrential rain leaves commuters stranded on car rooftops, floods several metro stations and causes flooding in the White House. (CNET)

International relations

- African Continental Free Trade Agreement

- African leaders agree on a continent-wide free trade zone, which encompasses all African nations except for Eritrea and Somaliland. The various European territories located in Africa are also excluded. It will be the largest free trade zone since the creation of the World Trade Organization. (DW)

Law and crime

- The International Criminal Court declares Bosco Ntaganda guilty of having committed war crimes during the Ituri conflict in the Democratic Republic of the Congo. (DW)

Politics and elections

- 2019 Greek legislative election

- Winner of the general election Kyriakos Mitsotakis is sworn in as the new Prime Minister of Greece, succeeding Alexis Tsipras. (Reuters)

- Tax returns of Donald Trump

- New York Governor Andrew Cuomo signs a bill that will allow congressional committees to access President Donald Trump‘s state tax returns. (The New York Times)

- Pope Francis names for first time in Vatican history female members of the Congregation for Institutes of Consecrated Life and Societies of Apostolic Life. (Catholic News Agency)

News from Wikipedia – please support this valuable resource